Supreme Infrastructure had fallen into bad times.

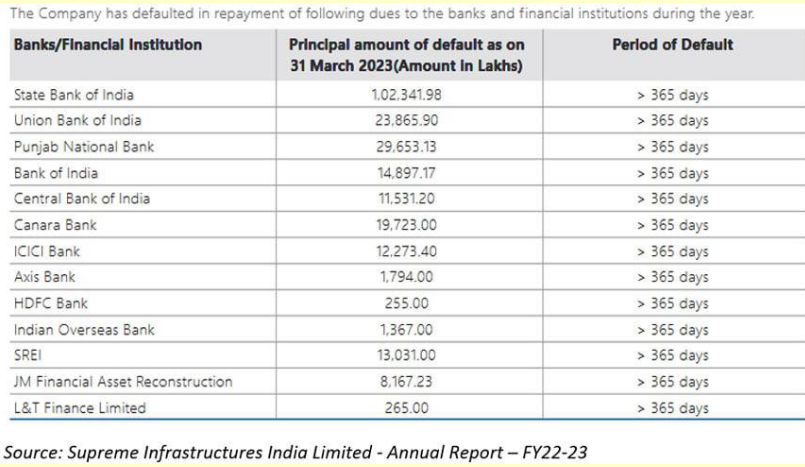

It had a debt of 2,200 Crores. This became NPA. The debt soon ballooned to 7093 Crores as 4093 Crores got added due to interest and unapplied interest.

SBI was one of the lead lenders to this company.

It had a debt of 1000 Crores itself as principal amount.

The lenders went to NCLT and a resolution plan was passed.

According to this resolution plan, the settlement of all debt will be done for 464 Crores. This works out to just 6.5% recovery. Even if one was to consider that the interest payment was not taken into account, the settlement works out to 21% of the original amount.

Thus the banks will take a 94.5% haircut (or loss of income) or 79% loss of capital depending on how you view the settlement.

But what is astounding is that SBI has taken a decision to buy shares in this company at a premium and is infusing 24.33 Crores of new money. It has thus created a first time precedence where a lender is also a share holder in the company!

What this indicates is that SBI is not too much bothered about recovering its dues but on the contrary is investing more money and is getting into a conflict of interest position.

Strange things are happening in the corporate world in India. The loot is taking place via NCLT.

The 79% loss of capital will be forever. It is not a recoverable amount once the NCLT settlement is agreed by everyone.

You know where this loss money will come from, it will come from your taxes….